Carbon Offsetting Myths Debunked: Insights

Carbon offsetting is often criticized, sometimes for good reasons—but many common claims conflate weak examples with high‑integrity practice. This guide debunks persistent myths, points to where problems truly lie, and shows how to use carbon offsetting credibly after reduction. For action, start with the free Coffset Carbon Footprint Calculator to measure, reduce, and then offset residuals in line with best practice.

Table of Contents

Why carbon offsetting myths persist

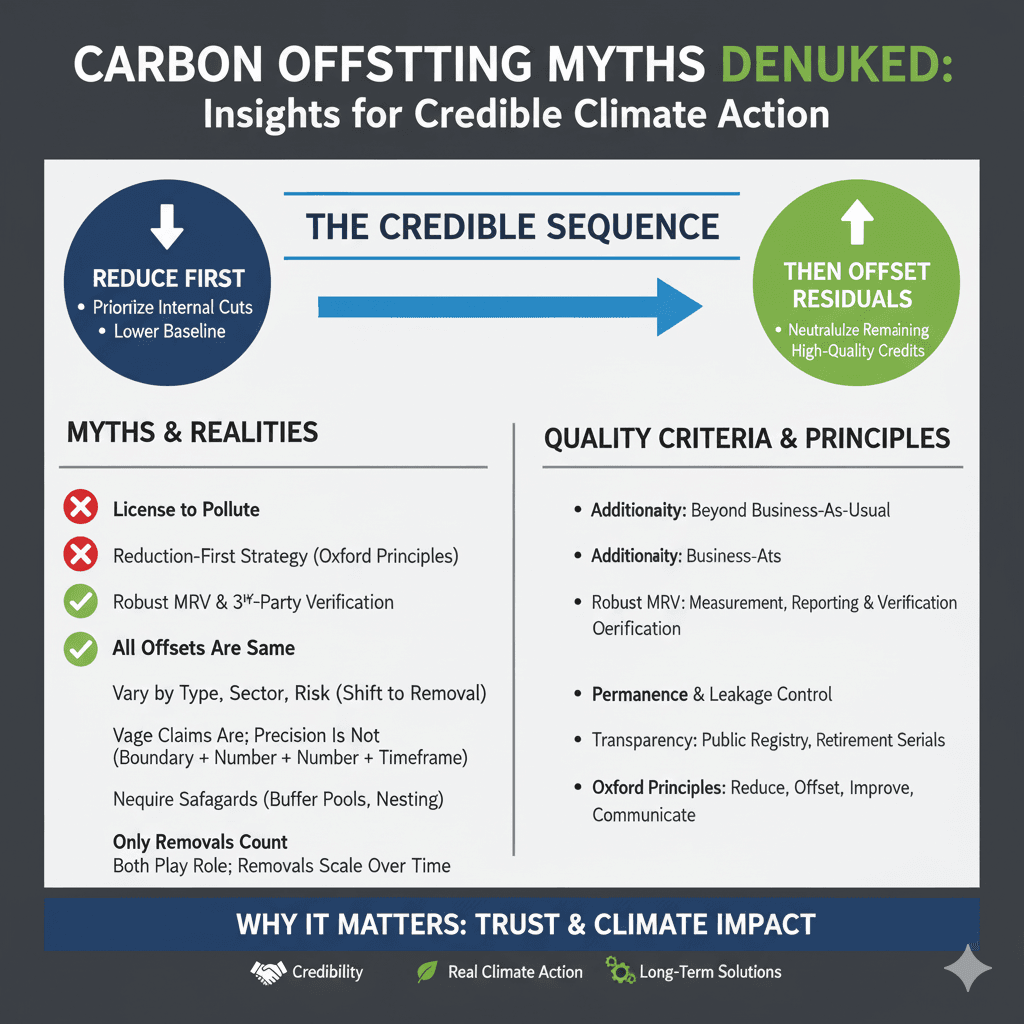

Myths endure because early markets had variable quality, some projects still use weak baselines, and claims are sometimes made without basic disclosures. High‑quality practice requires reduction‑first sequencing, stronger MRV, and transparent retirements—principles laid out clearly in the Oxford Offsetting Principles and explored in depth by Carbon Brief’s Q&A on offsets.

Myth 1: “Offsets are a license to pollute”

Credible strategies prioritize internal reductions and use offsets only for residual emissions. This reduction‑first sequence—and the gradual shift toward removals over time—is central to the Oxford Offsetting Principles. Analyses highlighting misuse do not negate carbon offsetting as a tool; they underscore the need to follow mitigation hierarchies and publish precise claims such as those dissected in Carbon Brief’s explainer.

Myth 2: “Offsets don’t reduce emissions in reality”

Quality varies, but high‑integrity credits are vetted through conservative baselines, robust monitoring, third‑party verification, and transparent registry retirement—core elements emphasized by both Carbon Brief’s Q&A and myth reviews from Ecosystem Marketplace. The right response to weak credits is due diligence and better standards, not abandoning verified offsetting altogether.

Myth 3: “All offsets are the same”

Offsets differ by mechanism (avoidance, reduction, removal), sector (land‑use, methane, energy, engineered), and risk profile. Portfolio design matters—buyers can prioritize metered methane capture now and increase durable removals over time, an evolution encouraged in the Oxford Offsetting Principles and unpacked by Carbon Brief.

Myth 4: “Offsets are greenwashing by definition”

Greenwashing stems from vague claims, not from carbon offsetting itself. Credible communication uses boundary + number + timeframe, plus verification reports and retirement serials. Practical guidance on precise claims and common pitfalls is discussed in Carbon Brief’s Q&A and misconception roundups like Ecosystem Marketplace’s myth debunk.

Myth 5: “Nature‑based projects aren’t trustworthy”

Land‑use projects face permanence and leakage risks, but those are addressed via buffer pools, jurisdictional nesting, and conservative accounting, as explained in Carbon Brief’s Q&A. The takeaway from market syntheses such as Ecosystem Marketplace’s analysis is not to avoid nature‑based projects—it’s to demand the right safeguards and documentation.

Myth 6: “Only removals count; reduction/avoidance is worthless”

Near‑term mitigation benefits significantly from high‑quality reduction and avoidance (e.g., methane capture), while portfolios should shift toward removals as residuals shrink—exactly the trajectory advised by the Oxford Offsetting Principles and analyzed in Carbon Brief’s Q&A.

Myth 7: “Offsets deprive the Global South of climate finance”

Poor design can misdirect funds, but well‑governed projects can channel finance into clean energy access, ecosystem stewardship, and livelihoods. The nuance and evidence base—including community safeguards and benefit‑sharing—are captured in market reviews and critical appraisals such as Carbon Brief’s Q&A.

Myth 8: “You can’t tell good from bad”

Quality is knowable with a short checklist: additionality, robust MRV, permanence/leakage safeguards, transparent documentation, and prompt retirement. Practical buyer guides and myth roundups from Ecosystem Marketplace and deep dives like Carbon Brief’s Q&A show how to apply this lens.

How to use carbon offsetting credibly

- Measure and reduce first: Baseline, implement high‑impact changes, and document boundaries and assumptions.

- Buy high‑quality credits: Require methodology, baseline, monitoring and verification reports, safeguards, and public retirement serials.

- Improve annually: Increase the share of removals over time while accelerating direct reductions.

- Communicate precisely: Boundary + number + timeframe, plus registry retirements—consistent with the Oxford Offsetting Principles.

Opinion: Two habits that end most myths

Most myths fade when two habits become non‑negotiable: reduction before offsetting, and evidence before claims. If a claim cannot say exactly what was reduced, what was offset, and which credits were retired, it shouldn’t be published. If residuals aren’t shrinking year‑over‑year, shift resources from offsets to deeper reductions.

Learn More

To take the next step on your low‑carbon journey, try the free Coffset Carbon Footprint Calculator to establish a precise baseline and identify your top opportunities for impact. After reducing what you can, offset the rest with verified projects that accelerate climate solutions. Explore more of our resources to stay informed: What Is a Carbon Footprint?, What Is Carbon Offsetting?, Reduce vs Offset: Why Both Matter. Each guide helps you cut emissions credibly while building lasting habits for a net‑zero future.

FAQs

- Is carbon offsetting greenwashing or real impact?

It depends on quality and claims. With reduction‑first sequencing, strong MRV and additionality, and public retirements, offsetting can deliver measurable impact—see Carbon Brief’s Q&A and the Oxford Offsetting Principles. - Are carbon removal credits always better than reduction/avoidance?

Both have roles. Near‑term mitigation benefits from high‑quality reduction/avoidance, while portfolios should gradually increase removals over time, per the Oxford Offsetting Principles. - How can individuals and SMEs evaluate options quickly?

Use a short checklist—additionality, MRV, permanence/leakage, transparency, retirement—drawing on buyer guides like Ecosystem Marketplace’s myth debunk and Carbon Brief’s Q&A. - Why do critiques keep resurfacing?

Weak credits still exist and generate headlines. Following net‑zero‑aligned buying principles and publishing precise claims addresses the root causes highlighted by Carbon Brief.

Sources

- Carbon Brief – In‑depth Q&A on offsets: https://interactive.carbonbrief.org/carbon-offsets-2023/

- Oxford Offsetting Principles (revised 2024): https://www.smithschool.ox.ac.uk/sites/default/files/2024-02/Oxford-Principles-for-Net-Zero-Aligned-Carbon-Offsetting-revised-2024.pdf

- Ecosystem Marketplace – Debunked myths: https://www.ecosystemmarketplace.com/articles/debunked-eight-myths-carbon-offsetting/