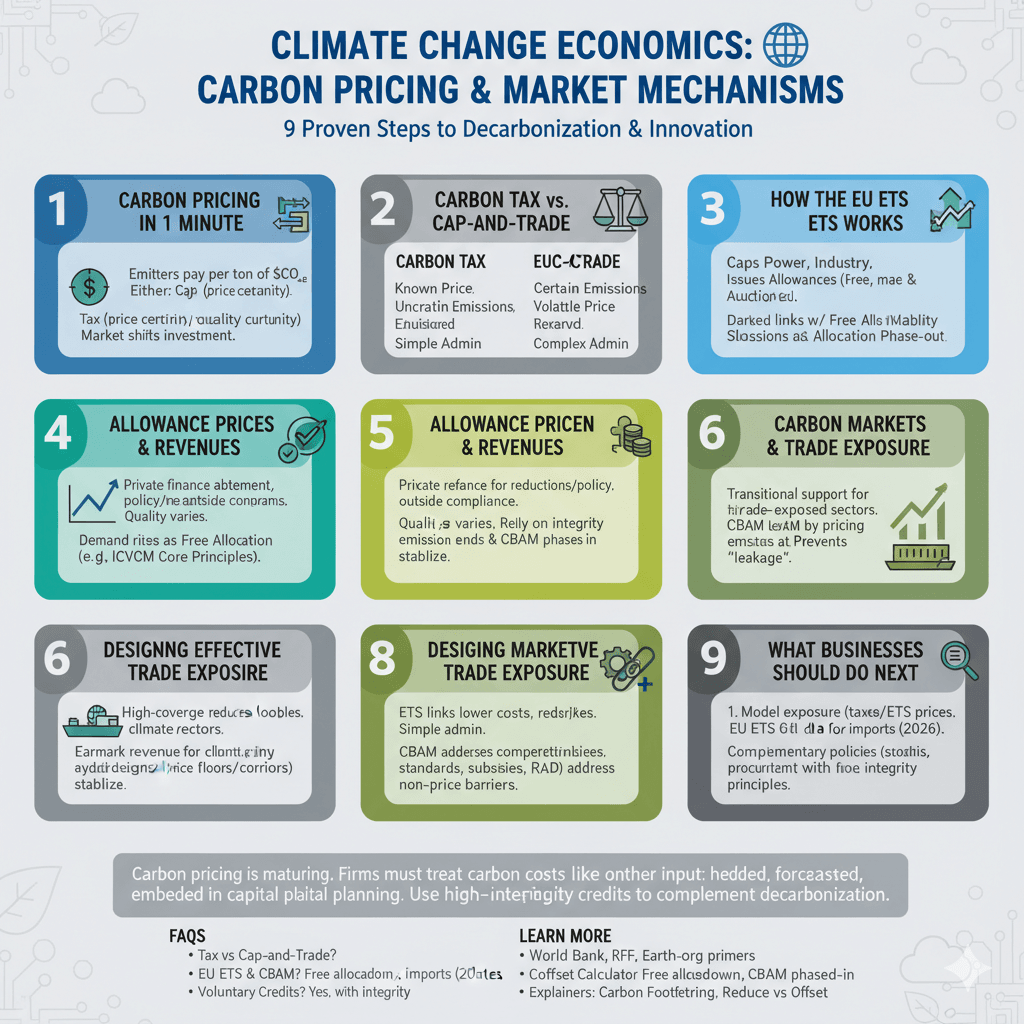

9 Proven Steps: Climate Change Economics — Carbon Pricing & Market Mechanisms

Climate Change Economics: Carbon Pricing & Market Mechanisms explains how carbon taxes, cap-and-trade systems, and credit markets put a price on pollution to drive least-cost decarbonization and innovation, drawing on plain-language primers such as the World Bank’s overview of what carbon pricing is and balanced comparisons like Cap and Trade Basics. For European context, the EU Emissions Trading System remains the world’s largest carbon market, with design features and CBAM linkages summarized by ICAP’s EU ETS explainer and the European Commission’s pages on free allocation and the Carbon Border Adjustment Mechanism.

Table of Contents

Introduction

This guide breaks down the economics behind carbon taxes and cap-and-trade, clarifies how allowance prices and auction revenues flow, and shows where voluntary carbon markets fit alongside compliance markets. For quick comparisons, see clear explainers such as RFF’s Carbon Pricing 101 and Earth.org’s review of cap-and-trade vs carbon tax.

Step 1 — Carbon pricing in one minute

CO2 pricing makes emitters pay per ton of CO₂e, either by setting a tax (price certainty) or by capping total emissions and letting allowance prices float (quantity certainty), a distinction explained by the World Bank’s intro to carbon pricing and RFF’s Carbon Pricing 101. In both cases, market signals shift investment toward cleaner technologies and operational efficiency as summarized in Cap and Trade Basics.

These instruments can be revenue-neutral, fund climate investment, or recycle proceeds to households and firms, depending on policy design; the EU shows how auction revenues scale with price and volume in ICAP’s EU ETS profile.

Step 2 — Carbon tax vs cap-and-trade

Carbon taxes set a known price per ton, leaving emissions outcomes uncertain, while cap-and-trade sets a firm emissions cap and lets the market find the price—clear contrasts captured in RFF’s CO2 Pricing 101 and C2ES’s Cap and Trade Basics. Practical pros and cons, like administrative simplicity of taxes versus emissions certainty in trading, are summarized in Earth.org’s comparison explainer.

Peer-reviewed syntheses align with this: surveys find the tax offers price certainty, trading offers quantity certainty, reflecting classic Weitzman-style tradeoffs, as reviewed in an academic survey of tax vs cap-and-trade in practice.

Step 3 — How the EU ETS works

The EU ETS caps emissions from power, industry, and aviation, issues allowances (some free, most auctioned), and allows trading, with a Market Stability Reserve to manage surplus—design elements captured by ICAP’s EU ETS explainer. Free allocation benchmarks and phase‑out pathways are documented by the Commission under free allocation.

CBAM complements the phase‑out of free allocation by charging imports for embedded emissions, with a transitional reporting phase since 2023 and definitive regime starting 2026 per the Commission’s CBAM page and ICAP’s notes on the EU ETS–CBAM synchronisation in the EU ETS profile.

Step 4 — Allowance prices and auction revenues

EU ETS allowance prices reflect marginal abatement expectations, policy changes, and macro conditions; revenues from auctions fund national and EU climate programs, with total proceeds tracked in ICAP’s EU ETS profile. As free allocation phases down and CBAM phases in, covered sectors’ demand for allowances rises, a dynamic highlighted in policy trackers like the Commission’s free allocation.

Price volatility is an expected feature of cap-and-trade, while taxes hold prices steady but leave emissions outcomes uncertain, a core tradeoff outlined by Cap and Trade Basics and Carbon Pricing 101.

Step 5 — Voluntary carbon markets and integrity

Voluntary carbon markets channel private finance to reductions and removals outside compliance systems, but quality varies; buyers increasingly rely on integrity guardrails like ICVCM’s Core Carbon Principles and government integrity principles such as the UK’s Voluntary Carbon and Nature Market Integrity principles. Policy consultations continue to clarify claims and credit use, as seen in the UK’s consultation on raising integrity.

Market guides offer plain-English intros to credit types, standards, and usage in both compliance-linked and voluntary contexts, such as CarbonCredits.com’s guide to carbon credits.

Step 6 — Carbon markets and trade exposure

Trade-exposed, emissions-intensive sectors receive transitional support under ETS designs, while CBAM aims to level the playing field by pricing embedded emissions at the border during the free allocation phase‑down, as described by ICAP’s EU ETS explainer and the Commission’s CBAM page. Free allocation benchmarks and gradual reductions are detailed in the Commission’s free allocation.

This package aims to prevent leakage while preserving decarbonization incentives inside the ETS cap, with administrative and data requirements ramping up across supply chains during the CBAM transition per the CBAM explainer.

Step 7 — Designing effective carbon taxes

High-coverage carbon taxes reduce loopholes and are administratively simple, while complementary policies can target sectors or innovation gaps; clear summaries of pros/cons appear in Earth.org’s comparison and RFF’s CO2 Pricing 101. Many tax systems earmark a portion of revenue for climate investment or household rebates, while integrating with other instruments to maintain political durability per World Bank’s CO2 pricing overview.

Hybrid designs—price floors in cap-and-trade or tax corridors—blend certainty attributes to stabilize investor expectations, reflecting lessons captured by Cap and Trade Basics.

Step 8 — Linking and complementarity

ETS linkages can lower costs and reduce leakage by broadening markets, while border adjustments like CBAM provide a different pathway to address competitiveness, with both approaches covered by ICAP’s EU ETS profile and the Commission’s CBAM explainer. Complementary policies—standards, subsidies, and R&D—work alongside CO2 pricing to address non-price barriers as described in Carbon Pricing 101.

Voluntary markets can complement compliance policies if integrity standards are met; buyers can use ICVCM’s Core Carbon Principles and government principles like the UK’s integrity principles to guide procurement.

Step 9 — What businesses should do next

- Model exposure under carbon taxes and ETS prices using public price histories and policy roadmaps summarized in ICAP’s EU ETS page.

- Prepare CBAM data on embodied emissions for covered imports as the definitive regime starts in 2026 per the CBAM page.

- If using voluntary credits, align procurement with ICVCM’s Core Carbon Principles and government guidance like the UK’s integrity principles.

Opinion

Carbon pricing is maturing into a global patchwork of taxes, ETSs, and border adjustments, and the enduring advantage goes to firms that treat carbon costs like any other input—hedged, forecasted, and embedded in capital planning—while using high‑integrity credits only to complement real decarbonization. Markets do the heavy lifting when guardrails are clear: robust ETS design, transparent tax policy, and integrity standards for credits together deliver the certainty investors need, as captured in policy primers from C2ES, RFF, and institutional overviews like the World Bank’s carbon pricing dashboard.

FAQs — Climate Change Economics: CO2 Pricing & Market Mechanisms

What’s the difference between a carbon tax and cap-and-trade?

A carbon tax sets the price per ton and leaves total emissions uncertain, while cap-and-trade caps emissions and lets prices float, as explained in Carbon Pricing 101 and Cap and Trade Basics.

How does the EU ETS interact with CBAM?

Free allocation phases down while CBAM phases in to price embedded emissions at the border, described in ICAP’s EU ETS profile and the Commission’s CBAM explainer.

Do voluntary carbon credits still matter?

Yes, when used with integrity and in addition to value-chain reductions; buyers can follow ICVCM’s Core Carbon Principles and the UK government’s integrity principles.

Where can I learn more about CO2 pricing design choices?

World Bank’s overview of what CO2 pricing is, RFF’s CO2 Pricing 101, and Earth.org’s tax vs ETS explainer are strong starting points.

Learn More

Explore practical next steps and foundational concepts in one place: start by testing scenarios with the free Coffset Carbon Footprint Calculator, then build fluency with our explainers What Is a Carbon Footprint?, What Is Carbon Offsetting?, and Reduce vs Offset: Why Both Matter. For more resources, visit the Coffset homepage, explore the Carbon Learning Center, or take action via Buy Carbon Credits.

Sources

- World Bank — What is CO2 Pricing?: https://carbonpricingdashboard.worldbank.org/what-carbon-pricing

- C2ES — Cap and Trade Basics: https://www.c2es.org/content/cap-and-trade-basics/

- RFF — Carbon Pricing 101: https://www.rff.org/publications/explainers/carbon-pricing-101/

- ICAP — EU Emissions Trading System (EU ETS): https://icapcarbonaction.com/en/ets/eu-emissions-trading-system-eu-ets

- European Commission — Free allocation (EU ETS): https://climate.ec.europa.eu/eu-action/carbon-markets/eu-emissions-trading-system-eu-ets/free-allocation_en

- European Commission — Carbon Border Adjustment Mechanism (CBAM): https://taxation-customs.ec.europa.eu/carbon-border-adjustment-mechanism_en

- ICVCM — Core Carbon Principles: https://icvcm.org

- UK Government — Principles for voluntary carbon and nature market integrity: https://www.gov.uk/government/publications/voluntary-carbon-and-nature-market-integrity-uk-government-principles/principles-for-voluntary-carbon-and-nature-market-integrity

- Earth.org — Cap-and-trade vs carbon tax: https://earth.org/cap-and-trade-vs-carbon-tax/