9 Proven Moves: Corporate Offsetting Programs — Case Studies of Success

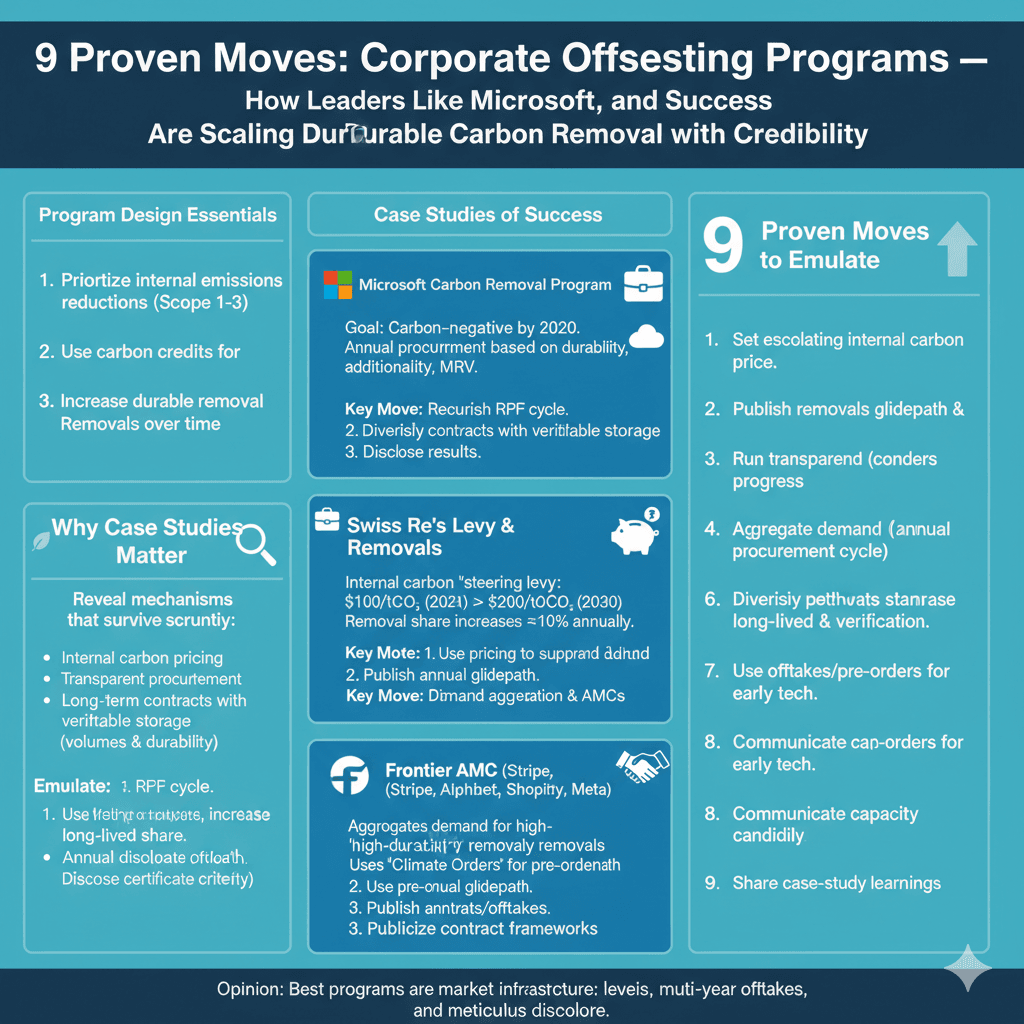

Corporate offsetting programs work best when they complement aggressive internal decarbonization, use high‑integrity credits, and progressively shift toward durable removals—an approach exemplified by leaders like Microsoft, Swiss Re, and the Frontier buyers coalition founded by Stripe. These case studies show how internal carbon pricing, advance market commitments, and long‑term offtakes can de‑risk early carbon removal technologies while maintaining credibility through transparency and rigorous MRV.

To replicate these results, design a portfolio strategy that prioritizes real reductions, then uses credits for residuals, with a glidepath that increases the share of long‑lived removals and discloses procurement criteria and progress annually. That playbook underpins Microsoft’s evolving Carbon Removal Program and Swiss Re’s steadily escalating internal levy and removal share documented in its 2024 Sustainability Report.

Table of Contents

Why case studies matter

Well‑documented programs reveal mechanisms that survive scrutiny: internal carbon pricing that funds removals, transparent procurement cycles, long‑term contracts with verifiable storage, and year‑over‑year disclosure of volumes and durability. Microsoft details its intake windows, criteria, and award rounds on its Carbon Removal Program, while Swiss Re discloses its levy schedule and removal trajectory in its Group Sustainability Report 2024.

Emerging coalitions also demonstrate how demand aggregation accelerates scale and learning rates for novel removal pathways; Frontier’s advance market commitment, launched by Stripe with partners, sends a durable demand signal for permanent removals as laid out in the Frontier launch announcement and subsequent coverage of “Climate Orders” for pre‑ordering offtakes in 2024 reported by Trellis.

Case 1 — Microsoft’s carbon removal program

Microsoft set a carbon‑negative goal for 2030 and built an annual procurement process that evaluates suppliers on durability, additionality, MRV, and co‑benefits, described on the Carbon Removal Program. The company’s 2024 Environmental Sustainability Report details progress on carbon‑free electricity and removals and is available in the 2024 ESG report PDF.

Recent reporting highlights large purchases across durable pathways—biochar, mineralization, DAC—and landmark regional projects, such as the Panna afforestation initiative in India, described in industry coverage of Microsoft’s “largest carbon removal deal in Asia,” including a 2025 news analysis from CarbonCredits.com. While project types vary, Microsoft’s direction of travel favors long‑lived removals and robust verification, reflected in summaries like Trellis’s review of “Microsoft’s mega‑purchases in durable carbon removal.”

Key moves to emulate:

- Establish a recurring RFP cycle with transparent criteria on durability and MRV, as shown in the program page.

- Blend pathway diversity while raising the share of long‑lived removals annually, as suggested by external reporting on recent purchase volumes via Trellis and regional deals via CarbonCredits.com.

- Disclose results and lessons learned in sustainability reports, such as the 2024 ESG report.

Case 2 — Swiss Re’s levy and removals glidepath

Swiss Re introduced an internal carbon “steering levy” to drive operational reductions and fund removals, starting at USD 100/tCO₂ in 2021 and rising toward USD 200/tCO₂ by 2030, with the share of removals increasing by about 10% each year—operational details were shared in a 2024 case study by Carbonfuture and expanded in Swiss Re’s 2024 Sustainability Report. The insurer’s CO2NetZero Programme outlines how operational cuts pair with staged procurement of avoidance and removal credits, summarized on the company’s CO2NetZero Programme page.

Swiss Re also explains its evolving mix of avoidance and removal certificates, including procurement disclosures for 2023, on its approach page for carbon certificates. The candid admission that net‑zero feasibility hinges on timely availability of removal capacity, captured in the 2024 report extract, underscores the need for early offtakes and market‑building. See the report excerpt in the 2024 sustainability report extract.

Key moves to emulate:

- Use internal pricing to both suppress demand and fund removals procurement, as described in the case study.

- Publish a year‑by‑year glidepath with removal share targets, documented in the 2024 report.

- Disclose certificate selection and quality criteria, per Swiss Re’s certificates approach.

Case 3 — Frontier’s advance market commitment (Stripe, Alphabet, Shopify, Meta and others)

Frontier aggregates demand for high‑durability removals via an advance market commitment that aims to reduce cost curves and scale supply through offtakes, introduced in the Frontier launch. In 2024 Stripe expanded access with “Climate Orders,” enabling pre‑ordering of offtake contracts with vetted providers, as reported by Trellis.

These mechanisms help early buyers back projects like Charm Industrial, CarbonCapture, and Heirloom, with certificates delivered as projects come online, which Trellis noted may begin as early as 2026 for some contracted volumes. The same model has supported unique applications such as incineration‑stack capture in Norway, covered in a 2025 round‑up of new offtakes by Trellis.

Key moves to emulate:

- Join or form buyer coalitions to pool diligence and send strong demand signals, per the Frontier announcement.

- Use pre‑orders and portfolio offtakes to manage price and delivery risk, as outlined by Trellis on Climate Orders.

- Publicize contract frameworks and verification approach to catalyze broader market confidence, as seen across Frontier communications and coverage via Trellis.

9 proven moves drawn from the leaders

- Set an internal carbon price or levy that escalates over time to fund removals while suppressing demand, following the Swiss Re model documented in its 2024 report and case study.

- Publish a durable‑removals glidepath and disclose annual progress with volumes, categories, and durability, as Microsoft does in its program page and ESG reporting.

- Run a transparent procurement cycle with clear criteria for additionality, MRV, and storage integrity, modeled on Microsoft’s annual intakes.

- Aggregate demand via coalitions or AMCs to accelerate learning curves and supply scale, as demonstrated by Frontier’s launch and 2024 Climate Orders.

- Diversify across pathways while increasing long‑lived storage share year‑over‑year, reflecting external reporting on Microsoft’s portfolio in Trellis and regional projects in CarbonCredits.com.

- Disclose certificate standards, ratings, and verification methods to build trust, as seen in Swiss Re’s certificates approach.

- Use offtakes and pre‑orders to lock supply and delivery windows for early‑stage technologies, per Frontier’s model and Trellis coverage.

- Communicate constraints candidly—durable capacity is a bottleneck—echoing Swiss Re’s feasibility framing in the report extract.

- Share case‑study learnings to lift the market’s baseline, as round‑ups of successful programs (e.g., TD, Microsoft, Disney, GM) illustrate in a 2024 review of corporate offset programs.

Program design essentials

A credible corporate offsetting program must fit into a broader decarbonization strategy that reduces Scope 1–3 emissions, with credits used for residuals, and a plan to raise durability over time. Microsoft’s approach to removals procurement, criteria, and reporting is a transparent benchmark in the program page, while Swiss Re’s levy and glidepath documents both the financial mechanism and the trajectory in the 2024 report.

Procurement teams can reduce transaction costs and risk by leveraging pooled diligence from coalitions like Frontier, whose AMC and pre‑order tools are described in the Frontier announcement and “Climate Orders” update via Trellis.

Opinion

The best corporate offsetting programs look less like ad‑hoc purchases and more like market infrastructure: internal levies, annual tenders, multi‑year offtakes, and meticulous disclosure that steadily shifts portfolios toward durable removals. This is how Microsoft’s procurement cycles and Swiss Re’s levy signal have turned ambition into an executable roadmap, while Frontier’s AMC shows how buyers can co‑create the market they need—per their own documentation in the program page, sustainability reports, and the Frontier launch.

FAQs — Corporate Offsetting Programs: Case Studies of Success

How do internal carbon prices fund better offsetting?

They curb operational emissions and generate dedicated budgets for removals, as Swiss Re demonstrates in its 2024 report and CO2NetZero Programme.

What makes Microsoft’s approach a strong template?

Transparency, recurring intakes, rigorous criteria, and growing emphasis on long‑lived removals outlined in the Carbon Removal Program and the 2024 ESG report.

Why join a buyers’ coalition?

Shared diligence and guaranteed demand can unlock offtakes for novel removals, as shown by the Frontier AMC and 2024 Climate Orders.

How to balance project types while improving integrity?

Diversify in the near term, but raise the share of durable removals annually, a pattern reflected in external coverage of Microsoft’s portfolio via Trellis and reported regional deals via CarbonCredits.com.

What disclosures build trust?

Volumes, durability mix, standards, verification, and forward commitments, modeled by Swiss Re’s certificates approach and program transparency in the 2024 report.

Learn More

Explore practical next steps and foundational concepts in one place: start by testing scenarios with the free Coffset Carbon Footprint Calculator, then build fluency with our explainers What Is a Carbon Footprint?, What Is Carbon Offsetting?, and Reduce vs Offset: Why Both Matter. For more resources, visit the Coffset homepage, explore the Carbon Learning Center, or take action via Buy Carbon Credits.

Sources

- Microsoft — Carbon Removal Program: https://www.microsoft.com/en-us/corporate-responsibility/sustainability/carbon-removal-program

- Microsoft — 2024 Environmental Sustainability Report (PDF): https://cdn-dynmedia-1.microsoft.com/is/content/microsoftcorp/microsoft/msc/documents/presentations/CSR/Microsoft-2024-Environmental-Sustainability-Report.pdf

- Swiss Re — Group Sustainability Report 2024 (full): https://www.swissre.com/dam/jcr:b17dff9d-c026-46e6-b3f9-a0839fb5ed65/2024-sustainability-report-en.pdf

- Swiss Re — 2024 Report Extract (CTP): https://www.swissre.com/dam/jcr:84dfce47-e0fe-468a-9f57-55c1c74c9b3a/2024-sustainability-report-CTP-extract-en.pdf

- Swiss Re — CO2NetZero Programme: https://www.swissre.com/sustainability/sustainable-operations/co2netzero-programme.html

- Swiss Re — Carbon certificates approach: https://www.swissre.com/sustainability/sustainable-operations/carbon-certificates.html

- Frontier (Stripe) — Launch announcement: https://frontierclimate.com/writing/launch

- Trellis — Stripe “Climate Orders” for pre‑ordering offtakes: https://trellis.net/article/stripes-new-service-lets-companies-buy-carbon-removal-projects-early/

- Trellis — Microsoft durable removal mega‑purchases: https://trellis.net/article/microsoft-durable-carbon-removal/

- CarbonCredits.com — Microsoft APAC afforestation deal: https://carboncredits.com/microsoft-and-climate-impact-partners-reveal-biggest-carbon-removal-deal-in-asia/