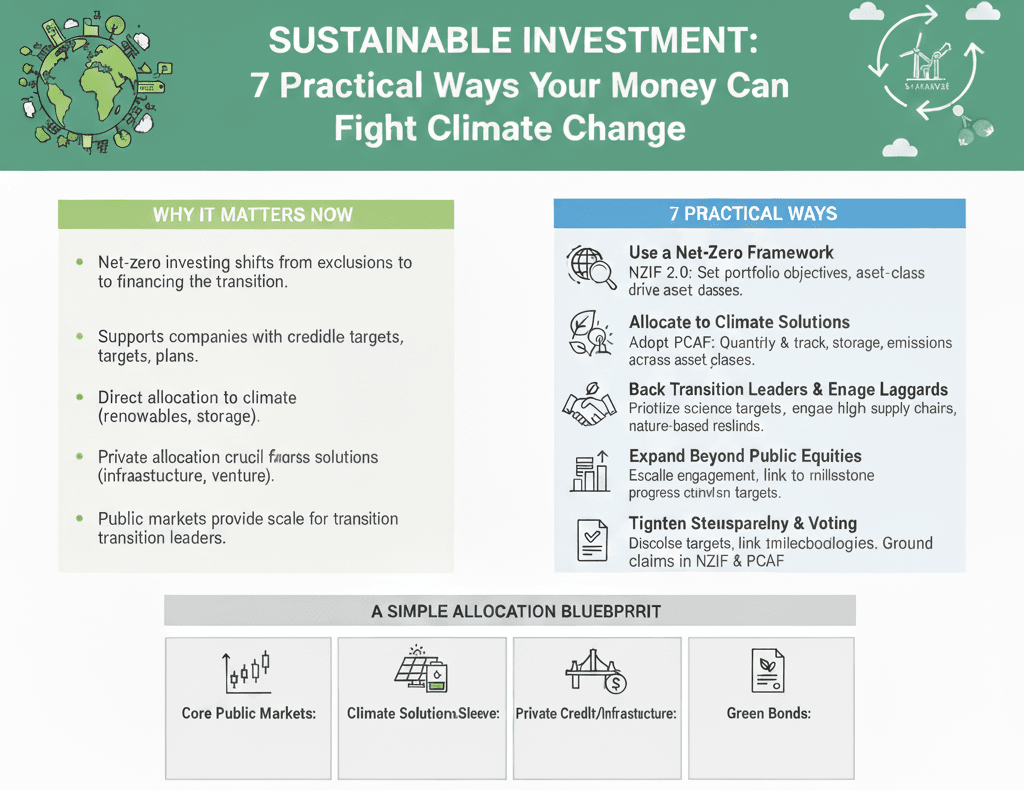

Sustainable Investment: 7 Practical Ways Your Money Can Fight Climate Change

Sustainable investment directs savings toward companies, projects, and funds that cut emissions, build climate solutions, and manage transition risks—without sacrificing fiduciary discipline. The most effective playbooks integrate net‑zero frameworks, measure financed emissions with standard methods, and allocate more capital to credible transition leaders and climate solutions across public and private markets. To keep personal finances aligned with footprint goals, track lifestyle emissions in the Coffset Carbon Footprint Calculator and use portfolio tools that mirror the same reduction‑first mindset.

Table of Contents

Why it matters now

- Net‑zero investing is shifting from exclusions to financing the transition—supporting companies with credible targets, plans, and capex, plus direct allocation to climate solutions such as renewables, storage, and efficiency technologies.

- Private markets are increasingly important for climate solutions, with strong multi‑year growth and differentiated opportunities across infrastructure and venture, while public markets provide scale and liquidity for transition leaders and enablers.

1) Use a net‑zero framework

Align strategy with the updated Net Zero Investment Framework (NZIF 2.0): set portfolio‑level objectives, define asset‑class targets, and emphasize engagement and capital allocation that drives real‑economy decarbonization. NZIF is the most widely used investor guide for building net‑zero strategies and transition plans across equities, credit, and real assets.

2) Measure financed emissions consistently

Adopt PCAF to quantify portfolio emissions and track progress with comparable metrics across asset classes (listed equity, corporate bonds, private debt, real estate, project finance, mortgages, vehicles, sovereigns). PCAF prescribes attribution rules, data‑quality scoring, and disclosure that aligns with global reporting frameworks, making financed‑emissions reporting decision‑useful.

3) Allocate to climate solutions

Increase exposure to companies and assets that build low‑carbon capacity and resilience—renewables, grid, storage, building retrofits, EV supply chain, nature‑based resilience, and adaptation technologies. Research highlights expanding opportunity sets and underappreciated adaptation themes that can diversify return drivers.

4) Back transition leaders and engage laggards

Prioritize issuers with science‑based targets, clear capex alignment, and transparent transition plans; engage high emitters to set targets and improve disclosures rather than blanket divestment. Markets now offer a wide range of climate‑labeled strategies that focus on transition leaders, enablers, and green bonds to channel capital where it moves the needle.

5) Expand beyond public equities

Use private credit, infrastructure, and project finance to fund tangible decarbonization and adaptation, guided by NZIF extensions for private debt and real assets. Private markets can complement public holdings by targeting capital gaps and generating measurable impact with robust underwriting and data practices.

6) Tighten stewardship and voting

Escalate engagement with escalation ladders—dialogue, co‑filings, voting, and capital reallocation—tied to milestone progress on targets and transition plans. Even amid policy headwinds, consistent stewardship remains a lever for aligning business models with a net‑zero trajectory.

7) Strengthen transparency and claims

Disclose portfolio targets, financed‑emissions baselines, and methodologies; avoid overstated “green” labels by grounding claims in NZIF and PCAF. Clear, comparable reporting improves accountability and reduces reputational risk while helping beneficiaries see how capital drives climate outcomes.

Putting it together: a simple allocation blueprint

- Core public markets: tilt to transition leaders and enablers; underweight unmanaged high‑carbon without plans; hold broad market where stewardship is active.

- Climate solutions sleeve: listed and private exposure to mitigation and adaptation themes (renewables, efficiency, resilience).

- Private credit/infrastructure: finance shovel‑ready decarbonization and resilience projects with robust KPIs and reporting.

- Green bonds: channel proceeds to eligible projects; monitor use‑of‑proceeds and impact reports for integrity.

Risk and resilience to watch

- Transition risk: policy shifts, carbon pricing, stranded assets in fossil‑dependent sectors.

- Physical risk: asset‑level exposure to heat, flood, and storms; favor resilience investments and robust risk disclosures.

- Data and greenwashing risk: use standardized methods (NZIF, PCAF) and independent verification where available; prefer managers with transparent methodologies and engagement records.

Opinion: Capital as a climate accelerator

The next phase of sustainable investment is less about purity screens and more about accelerating credible transition and solutions—moving from “less harm” to “more good” with disciplined frameworks. Portfolios that pair NZIF’s target setting with PCAF’s measurement and active allocation to solutions will likely drive more real‑economy decarbonization than exclusion‑only approaches, while maintaining diversified risk control across public and private markets.

Learn More

- Read the Net Zero Investment Framework 2.0 summary and implementation guidance to structure portfolio‑level targets and asset‑class levers NZIF 2.0 summary and NZIF implementation guide.

- Start measuring financed emissions with the PCAF Standard and plan a staged data‑quality upgrade over 12–24 months PCAF Standard and Financed emissions disclosure.

- Track personal lifestyle progress in parallel with the Coffset Carbon Footprint Calculator to keep spending and investing aligned.

FAQs

- What’s the fastest way to align a portfolio with climate goals?

Adopt NZIF 2.0 for targets and levers, measure with PCAF, tilt toward transition leaders and climate solutions, and escalate stewardship where plans are absent. - Do sustainable investments hurt returns?

Evidence points to competitive performance, with private climate solutions showing strong multi‑year growth; outcomes depend on selection, valuation discipline, and risk control rather than “ESG” labels alone. - How should fixed income be handled?

Use issuer‑level transition assessments, allocate to green/sustainability‑linked bonds with strong KPIs, and engage on use‑of‑proceeds and transition plans; manage duration and credit risk as usual. - What’s a practical starting allocation?

Keep a diversified core, add a climate solutions sleeve (public and private), establish stewardship priorities, and publish NZIF/PCAF‑aligned targets and metrics within 12 months.

Sources

- PAII – Net Zero Investment Framework 2.0 (summary and methodology): https://www.parisalignedassetowners.org/net-zero-investment-framework/ and https://www.parisalignedassetowners.org/media/2024/06/PAII_NZIF-2.0_240624_Final.pdf

- IIGCC – NZIF Implementation Guidance (2025): https://igcc.org.au/wp-content/uploads/2025/01/NZIF-Implementation-Guidance.pdf

- PCAF – Global GHG Accounting Standard and Disclosure: https://carbonaccountingfinancials.com/standard and https://carbonaccountingfinancials.com/files/institutions_downloads/Financed-Emissions-Disclosure.pdf

- MSCI Research – Sustainability and climate investing trends 2025: https://www.msci.com/research-and-insights/blog-post/what-could-shape-sustainability-and-climate-investing-in-2025

- UN Global Compact – Rise of sustainable finance (market insights): https://unglobalcompact.org/compactjournal/investing-future-rise-sustainable-finance

- Sustainalytics/Morningstar – Policy and market dynamics in 2025: https://www.sustainalytics.com/esg-research/resource/investors-esg-blog/public-policy-drives-sustainable-investing-markets-in-2025

- Insight Investment – Climate Change Report 2025 (stewardship and fixed income): https://www.insightinvestment.com/globalassets/documents/responsible-investment/responsible-investment-reports/uk-eu—climate-change-report-2025.pdf