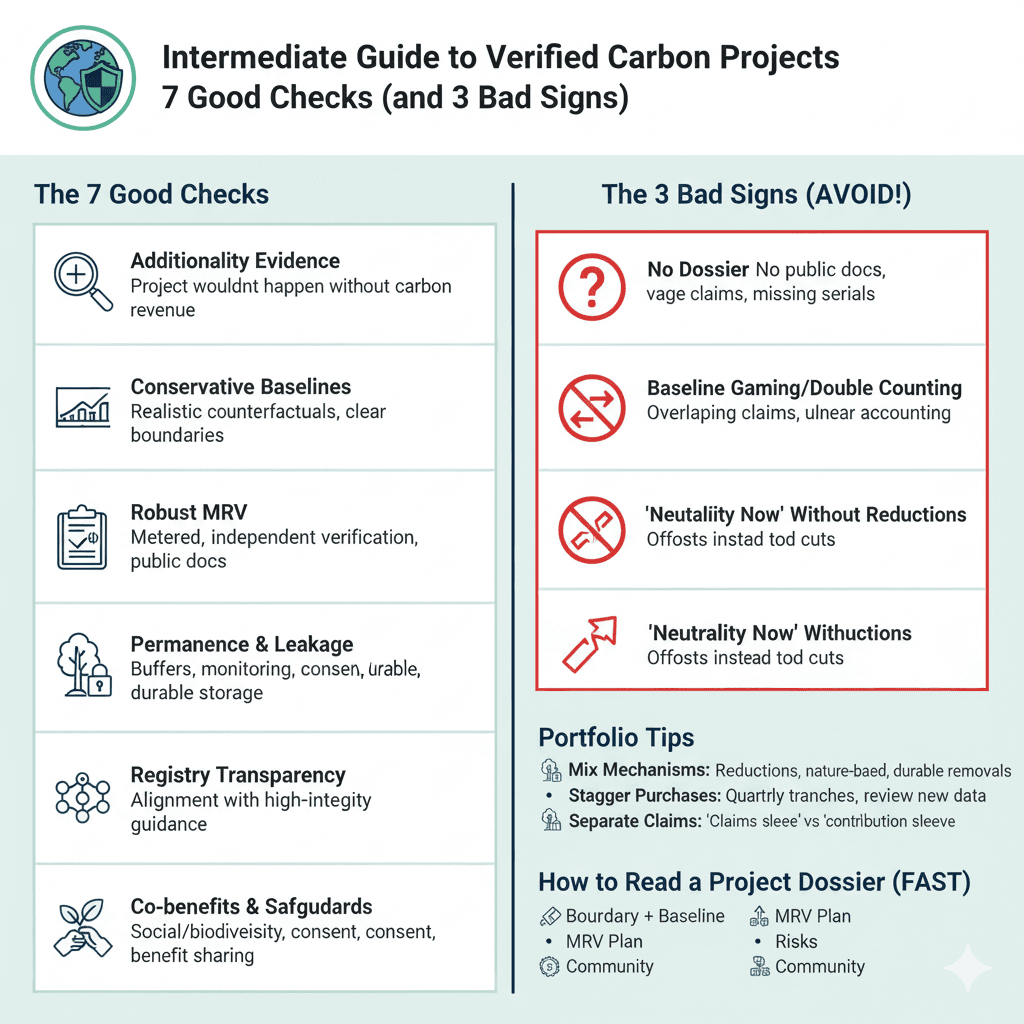

Intermediate Guide to Verified Carbon Projects: 7 Good Checks (and 3 Bad Signs)

Verified carbon projects can be a force for good when they deliver measurable, additional climate benefit—but not all credits are equal, and some common red flags still slip through. This intermediate guide gives seven good checks to apply before buying and three bad signs to avoid, so decisions about verified carbon projects are confident, defensible, and aligned with a reduction‑first strategy. To size residual emissions before any purchase, baseline with the Coffset Carbon Footprint Calculator and reserve verified carbon projects for what remains after in‑house cuts.

Table of Contents

Why verified projects matter

High‑integrity verified projects channel finance to real reductions and removals—expanding clean energy, cutting methane, protecting and restoring ecosystems, and advancing engineered storage—while buyers focus on reducing their own emissions first. The goal is not “credits instead of cuts,” but “cuts first, then credible compensation” with transparent documentation and retirement for verified carbon projects.

The 7 good checks:

- Additionality evidence

Look for clear tests (financial, regulatory, common practice) showing the project would not happen without carbon revenue, plus sensitivity on key drivers. Verified carbon projects without robust additionality are at high risk of over‑crediting. - Conservative baselines and boundaries

Demand conservative counterfactuals, jurisdictional nesting for land‑use, and clearly stated project boundaries; weak baselines are the most common failure mode in verified carbon projects. - Robust MRV (measurement, reporting, verification)

Prefer metered or directly measured outcomes where possible (e.g., methane capture), independent verification at defined intervals, and public documentation. Strong MRV is the backbone of verified carbon projects. - Permanence safeguards and leakage control

For nature‑based verified carbon projects, expect buffer pools, monitoring, and jurisdictional frameworks to handle reversals and leakage; for engineered removals, expect durable storage and transparent life‑cycle accounting. - Registry transparency and serials

Only buy credits issued with unique serial numbers in reputable registries, verify issuance and retirement records, and keep a simple ledger. Transparency is non‑negotiable for verified carbon projects. - Co‑benefits and safeguards

Prefer verified carbon projects with documented social and biodiversity safeguards, grievance mechanisms, informed consent processes, and benefit sharing; quality co‑benefits do not replace climate integrity but strengthen project durability. - Alignment with evolving principles

Favor verified carbon projects that can be mapped to high‑integrity guidance (e.g., reduction‑first portfolios, a rising share of removals over time, durable storage pathways), and keep claims conservative as policies evolve.

The 3 bad signs to avoid:

- “Trust us” with no dossier

No public design docs, no verification reports, no registry serials, or vague claims about impact—walk away from verified projects presented without documentation. - Baseline gaming or double counting risk

Grandiose “what would have happened” scenarios, overlapping claims with other programs, or unclear host‑country accounting—these undermine verified carbon projects regardless of marketing. - “Neutrality now” narratives without reductions

If the sales pitch says offsets replace decarbonization, or “carbon neutral” is promised without deep cuts, this is a signal to pause. Verified carbon projects belong after reductions, not instead of them.

Portfolio tips:

- Mix mechanisms

Balance metered reductions/avoidance (e.g., landfill gas, industrial methane) with nature‑based removals (strong buffers/nesting) and a growing sleeve of durable removals. This improves resilience and future‑proofs claims. - Stagger purchases

Buy in quarterly tranches, review new verification events, and incorporate improved data or methodologies as verified carbon projects evolve. - Separate claims vs contributions

Keep a “claims sleeve” to compensate residuals with retired credits and a separate “contribution sleeve” for beyond‑value‑chain support that is not used in footprint claims.

How to read a project dossier (fast)

- Boundary + baseline: conservative, current, jurisdiction‑aware.

- MRV plan: data sources, verification cadence, uncertainty treatment.

- Risks: permanence/leakage mitigation and buffers.

- Registry: serials, issuance, and retirement links.

- Community: safeguards, engagement, and benefit sharing.

- Summary: one‑page memo capturing the above for each of the verified projects under consideration.

Opinion: Evidence beats enthusiasm

For verified carbon projects, marketing is easy—evidence is hard. Make a rule: no serials, no sale; no baseline details, no buy. Insist on boundary + number + timeframe in claims, and keep reductions ahead of purchases. This is how verified projects become a precise tool, not a distraction.

Learn More

Explore practical next steps and foundational concepts in one place: start by testing scenarios with the free Coffset Carbon Footprint Calculator, then build fluency with our explainers What Is a Carbon Footprint?, What Is Carbon Offsetting?, and Reduce vs Offset: Why Both Matter. For more resources, visit the Coffset homepage, explore the Carbon Learning Center, or take action via Buy Carbon Credits.

FAQs – Intermediate Guide

- What makes verified carbon projects “high‑quality”?

Demonstrable additionality, conservative baselines, strong MRV, permanence/leakage safeguards, transparent registries, and clear retirements define high‑quality verified carbon projects. - How should portfolios of verified projects evolve over time?

Start with strong reductions/avoidance and nature‑based removals, then steadily increase durable removals while shrinking residual emissions each year. - Can verified carbon projects replace internal reductions?

No—verified carbon is for residuals only. Use them after measurable in‑house reductions and publish the retirement details with each claim. - What documents should be requested before buying verified carbon credits?

Project design docs, validation/verification reports, MRV plans, registry serials and retirement links, and community safeguard information.

Sources

- ICVCM – Core Carbon Principles (quality threshold, governance, impact, safeguards): https://icvcm.org/core-carbon-principles/ and Assessment Framework v1.1: https://icvcm.org/wp-content/uploads/2024/02/CCP-Book-V1.1-FINAL-LowRes-15May24.pdf

- ICVCM – Assessment Status (programs/categories under review): https://icvcm.org/assessment-status/

- UNFCCC – Article 6 overview (accounting, corresponding adjustments): https://unfccc.int/process-and-meetings/the-paris-agreement/article6

- Columbia SIPA – How to fully operationalize Article 6 (implications for buyers and claims): https://www.energypolicy.columbia.edu/publications/how-to-fully-operationalize-article-6-of-the-paris-agreement/

- Ecosystem Marketplace – State of the Voluntary Carbon Market 2025 (demand shifts, integrity trends): https://www.ecosystemmarketplace.com/publications/2025-state-of-the-voluntary-carbon-market-sovcm/

- VCMI – Carbon Markets Access Toolkit (buyer guidance and claim integrity): https://vcmintegrity.org/carbon-markets-access-toolkit/

- World Bank – Country Guidance for Navigating Carbon Markets (host‑country authorization, CA context): https://openknowledge.worldbank.org/entities/publication/957aaef4-75c9-4554-95db-cb0a6ff678e9