Advanced Guide to Carbon Offsetting Markets

Carbon offsetting markets are undergoing the most significant overhaul since their inception. High‑integrity labels, new accounting rules, ratings, and transparency tools are changing how credits are issued, traded, retired, and claimed—across both voluntary markets and emerging Paris Agreement Article 6 channels. This advanced guide maps the moving parts, explains current integrity guardrails, and offers a playbook for individuals and SMEs to participate credibly—always reduction‑first, with documented, high‑quality purchases and precise claims. To translate strategy into action, baseline first with the free Coffset Carbon Footprint Calculator, reduce what’s feasible, then offset the residuals with traceable retirements.

Table of Contents

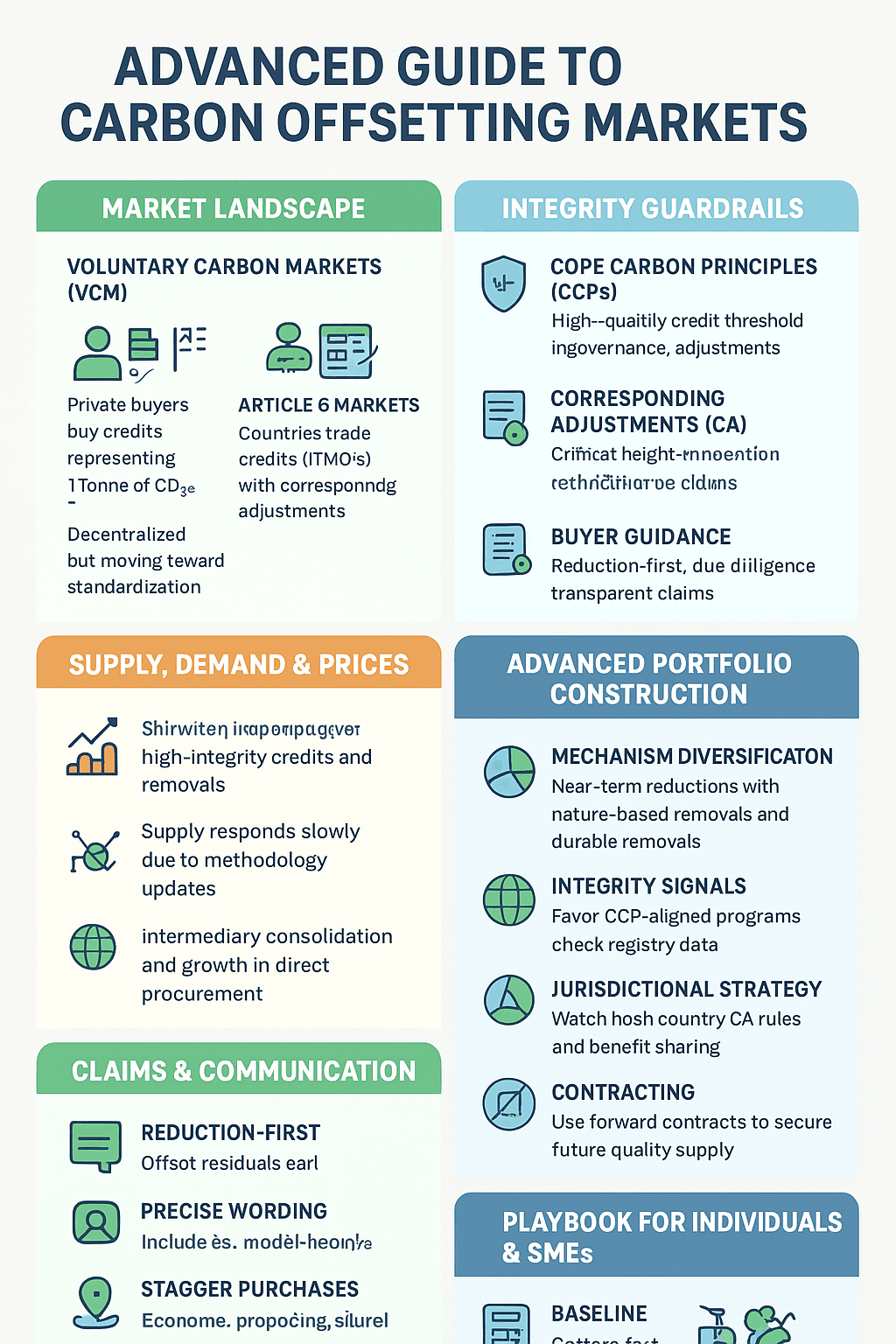

Market landscape now

Voluntary markets connect private buyers to credits representing one tonne of CO₂e reduced or removed, while Article 6 creates intergovernmental trade with corresponding adjustments to prevent double counting. The voluntary carbon market remains decentralized but is being standardized by integrity initiatives, while Article 6 lays out compliance‑grade accounting between countries and authorized private actors under the Paris Agreement The VCM explained by ICVCM and Article 6 overview (UNFCCC) and Columbia Energy Policy explainer on Article 6.2/6.4.

Integrity guardrails: CCPs, CA, labels

- Core Carbon Principles (CCPs): A quality threshold from the Integrity Council for the Voluntary Carbon Market to identify high‑quality credits across governance, emissions impact (additionality, permanence, quantification, no double counting), and sustainable development safeguards. Programs and categories are being assessed against the framework, enabling “CCP‑Approved” tagging over time ICVCM Core Carbon Principles and CCP Assessment Framework v1.1 and ICVCM assessment status.

- Corresponding Adjustments (CA): Under Article 6.2, cross‑border transfers require seller and buyer inventory adjustments to prevent double counting; 6.4 will introduce a centralized mechanism. For corporate buyers, whether a credit carries a CA may affect claim wording and country relationships Article 6 overview (UNFCCC) and Operationalizing Article 6 (Columbia).

- Buyer and policy guidance: Foundational guidance for responsible procurement and investment in private markets emphasizes reduction‑first strategies, due diligence, and transparent claims—mirrored in multiple investor and government toolkits VCMI Carbon Markets Access Toolkit and PRI/iCI private markets guidance.

Supply, demand, and price dynamics

Market overviews track shifting demand toward credits with higher integrity signals (strong MRV, permanence guardrails, social safeguards) and toward removals, while supply responds slowly due to development lead times and methodology updates. State‑of‑market reports note consolidation among intermediaries and growth in direct procurement and offtakes by large buyers SOVCM 2025 (Ecosystem Marketplace) and Environmental Finance VCM Rankings and CarbonCredits.com market sizing.

Article 6 vs. voluntary markets: how they interact

Article 6 enables countries to trade authorized credits (ITMOs) with corresponding adjustments; voluntary markets continue to serve private buyers with credits from established standards, increasingly tagged with integrity labels. Host‑country strategies influence whether activities are reserved for NDCs or offered to external buyers, shaping availability and pricing. Buyers should decide if and when CA‑tagged units are needed for specific claims or jurisdictions World Bank country guidance and GGGI practical guide to Article 6.

Portfolio construction for advanced buyers

- Mechanism diversification: Blend metered reductions/avoidance (e.g., methane capture) for near‑term impact with nature‑based removals (robust buffers/nesting) and budget‑constrained durable removals; shift the mix toward removals over time aligned with net‑zero pathways.

- Integrity signals: Favor CCP‑aligned programs/categories as assessments finalize; check registry data, methodologies, and third‑party ratings as inputs to due diligence.

- Jurisdictional strategy: Watch host‑country Article 6 positions, authorization policies, benefit‑sharing rules, and CA practices; these influence long‑term access and narrative credibility.

- Contracting: Use offtakes and forward contracts to secure future supply (especially removals), define delivery windows, remedies, and data access, and to lock in quality attributes ICVCM CCPs and status and SOVCM 2025.

Claims and communications: getting it right

- Reduction‑first: Document annual decarbonization, then compensate residuals.

- Precise wording: Boundary + tonnes + timeframe; disclose program, methodology, project docs, and registry serials/retirements.

- CA clarity: If using Article 6 units or CA‑tagged credits, indicate the relationship to the claim and host‑country accounting.

- Avoid lock‑in: Don’t frame credits as substitutes for decarbonization; position as complements that accelerate mitigation beyond the value chain ICVCM VCM overview and VCMI toolkit.

Risk management checklist

- Baseline risk: Are counterfactuals conservative and current?

- MRV: Metered vs. model‑heavy; uncertainty treatment; verification cadence.

- Permanence/leakage: Buffers, monitoring, and jurisdictional nesting in land‑use; long‑lived storage in engineered removal.

- Legal/policy: Host‑country authorization rules, CA implications, and export taxes/benefit sharing.

- Delivery: Developer track record, offtake performance, registry issuance timelines.

- Concentration: Diversify by program, region, methodology, developer, and vintage CCP Assessment Framework and Columbia on Article 6 integrity.

Playbook for individuals & SMEs

- Start with accounting: Baseline using the free Coffset Carbon Footprint Calculator; prioritize reductions each quarter.

- Buy fewer, higher‑quality tonnes: Insist on program/methodology docs, verification reports, and public retirements; look for CCP‑aligned categories as they become available.

- Stagger purchases: Quarterly tranches to average market conditions and incorporate new supply.

- Separate claims vs. contributions: Compensate residuals in a claim sleeve; support innovation or community projects in a contribution sleeve without linking to the footprint.

- Publish a one‑pager: Boundary, tonnes reduced, tonnes compensated, programs/methodologies, serials retired, CA status (if any), and next‑year removal share target ICVCM overview and SOVCM 2025.

Opinion: The “CCP + CA where needed” strategy

For most non‑sovereign buyers, the pragmatic strategy now is twofold: adopt CCP‑aligned quality screens as they roll out, and add CA‑tagged units only where claim strategy or jurisdiction clearly requires it. Meanwhile, keep shifting the mix toward removals in line with net‑zero timelines. This avoids paying a blanket premium for CA where it adds no claim value, while signaling integrity through CCPs and transparent retirements.

Learn More

To take the next step on your low‑carbon journey, try the free Coffset Carbon Footprint Calculator to establish a precise baseline and identify your top opportunities for impact. After reducing what you can, offset the rest with verified projects that accelerate climate solutions. Explore more of our resources to stay informed: What Is a Carbon Footprint?, What Is Carbon Offsetting?, Reduce vs Offset: Why Both Matter. Each guide helps you cut emissions credibly while building lasting habits for a net‑zero future.

FAQs – Carbon Offsetting Markets

- What’s the difference between Article 6 credits and voluntary market credits?

Article 6 units are accounted between countries with corresponding adjustments; voluntary credits are issued by independent programs for private buyers. Claims and pricing can differ based on CA and host‑country policy UNFCCC Article 6 and Columbia operationalization guide. - How should buyers use CCP‑Approved labels?

Use CCPs as a threshold screen for quality and combine with project‑level due diligence and registry checks; labels are not substitutes for reading the dossier ICVCM CCPs and Assessment status. - Do I need CA‑tagged credits for every claim?

Not typically. Use CA where claim strategy or jurisdiction requires alignment with national accounting; otherwise prioritize quality and transparency via CCP screens and public retirements UNFCCC Article 6 and VCMI toolkit. - Are removals always preferable to reductions/avoidance?

Both are needed; shift toward removals over time while maintaining strong near‑term reductions/avoidance with robust MRV and safeguards ICVCM VCM overview and SOVCM 2025.

Sources

- ICVCM – The Voluntary Carbon Market Explained: https://icvcm.org/voluntary-carbon-market-explained/

- ICVCM – Core Carbon Principles: https://icvcm.org/core-carbon-principles/ and Assessment Framework v1.1: https://icvcm.org/wp-content/uploads/2024/02/CCP-Book-V1.1-FINAL-LowRes-15May24.pdf and Assessment Status: https://icvcm.org/assessment-status/

- UNFCCC – Article 6 of the Paris Agreement: https://unfccc.int/process-and-meetings/the-paris-agreement/article6

- Columbia – Operationalizing Article 6: https://www.energypolicy.columbia.edu/publications/how-to-fully-operationalize-article-6-of-the-paris-agreement/

- Ecosystem Marketplace – State of the VCM 2025: https://www.ecosystemmarketplace.com/publications/2025-state-of-the-voluntary-carbon-market-sovcm/

- VCMI – Carbon Markets Access Toolkit: https://vcmintegrity.org/carbon-markets-access-toolkit/

- World Bank – Country Guidance for Navigating Carbon Markets: https://openknowledge.worldbank.org/entities/publication/957aaef4-75c9-4554-95db-cb0a6ff678e9