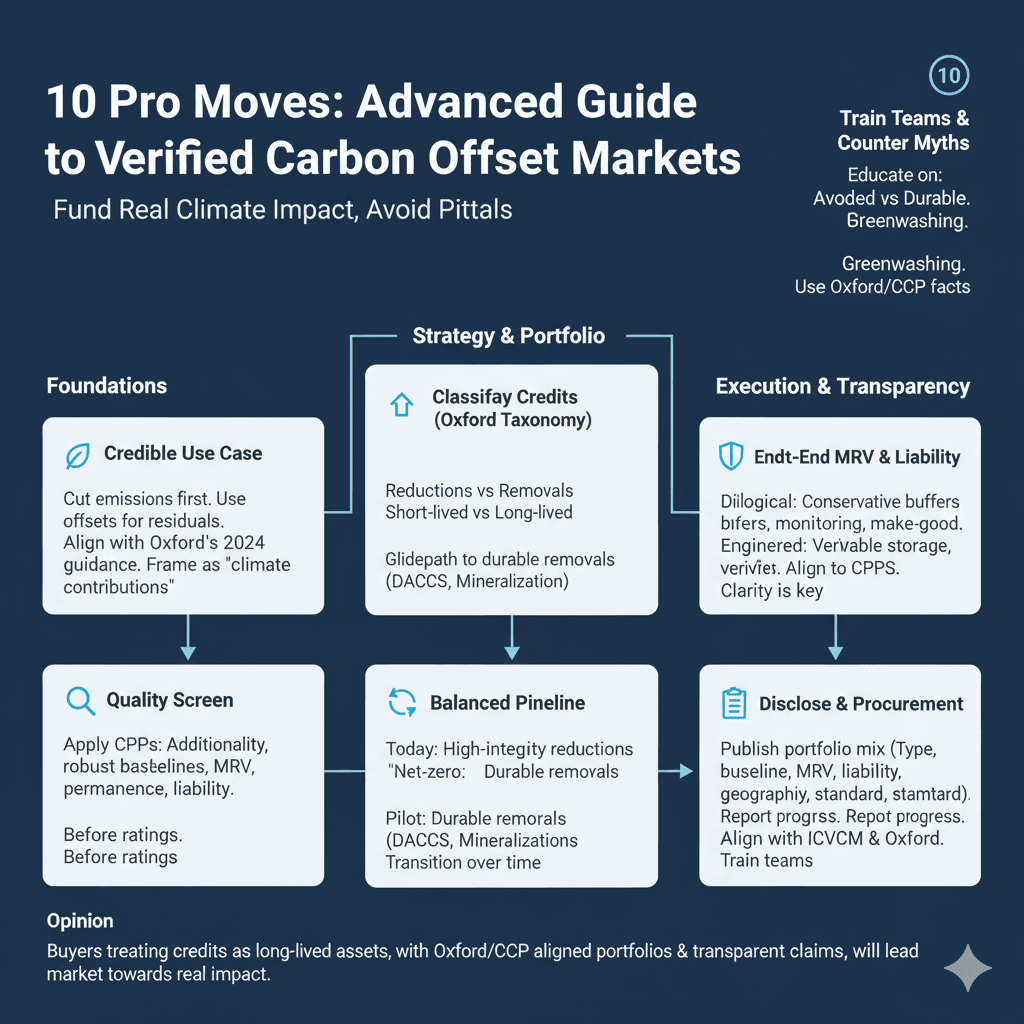

10 Pro Moves: Advanced Guide to Verified Carbon Offset Markets

Advanced Guide to Verified Carbon Offset Markets explains how today’s voluntary markets are converging on clearer quality standards, durable removals, and transparent claims—so buyers can fund real climate impact while avoiding reputational and accounting pitfalls. The playbook below integrates best‑practice guardrails such as core quality criteria, claims frameworks, and Oxford‑aligned portfolios that shift from reductions to durable removals over time. For strategy baselines and buyer guardrails, see accessible overviews of what offsets do and don’t do in Carbon Brief’s long‑form Q&A on carbon offsets and permanence, Oxford’s revised principles for net zero‑aligned offsetting, and the ICVCM’s governance portal for the Core Carbon Principles.

Table of Contents

The Guide

This guide is geared to practitioners building portfolios, writing claims, and preparing disclosures under tightening national guidance and corporate standards. It maps market roles across standards, registries, rating agencies, and claims initiatives, and shows how to operationalize due diligence from project screening to MRV and liability terms. For official primers and living guidance, consult the Smith School’s hub for Oxford Offsetting Principles and ICVCM’s evolving materials on the CCP program.

Move 1 — Start with a credible use case

Offsets are not a substitute for value‑chain decarbonization; credible strategies cut emissions first, then address residuals through high‑quality credits—an approach codified in Oxford’s revised 2024 guidance on net zero‑aligned offsetting. Public claims should match credit durability and role (contribution vs residual offsetting), a principle reinforced in Carbon Brief’s explainer on equivalence and permanence.

Framing portfolios as climate contributions during transition years reduces risk of over‑claiming and aligns with market integrity initiatives and Oxford’s migration to durable removals by target dates; see Oxford’s hub for principles and buyer roles in the offsetting framework.

Move 2 — Use a quality screen before ratings

Apply first‑line criteria—additionality, robust baselines, conservative leakage treatment, permanence buffers/liability, and auditable MRV—before consulting any external rating, as codified by the Integrity Council’s Core Carbon Principles. These criteria tackle the main failure modes documented across market critiques summarized by Carbon Brief’s Q&A on offset credibility challenges.

A pre‑rating screen avoids false precision from summary scores when project documentation fails minimum thresholds; CCP alignment provides a common language for procurement teams, detailed at ICVCM’s CCP overview.

Move 3 — Classify credits by action and durability

Use the Oxford taxonomy to separate reductions from removals, and short‑lived from long‑lived storage, then set a glidepath to increase the share of durable removals (e.g., DACCS, mineralization) by the net‑zero date; see the revised 2024 Oxford principles for portfolio migration. The Smith School’s hub contextualizes how buyers phase Types I–III toward Types IV–V in the framework overview.

Why it matters: permanence risk affects equivalence with fossil emissions and therefore the defensibility of net‑zero claims, an issue laid out in Carbon Brief’s explainer on permanence and reversals.

Move 4 — Write claims that match durability

Align language to what is actually purchased: near‑term portfolios heavy in reductions should be framed as “climate contributions,” while net‑zero end‑state claims should rest primarily on durable removals, per Oxford’s revised guidance on claims integrity. Avoid implying tonne‑for‑tonne equivalence when permanence risks differ materially, a concern highlighted in Carbon Brief’s offsets Q&A.

This alignment reduces reputational risk and is consistent with how integrity initiatives are shaping buyer disclosures, reinforced in Oxford’s principle summaries at the Smith School hub.

Move 5 — Demand end‑to‑end MRV and clear liability

For biological storage, require conservative buffers, reversal monitoring, and make‑good provisions to address fires, pests, or land‑use change; these are central to CCP‑style due diligence in ICVCM’s Core Carbon Principles. For engineered removals, require verifiable transport, injection, and post‑closure monitoring with clear responsibility for storage integrity, consistent with permanence concerns summarized in Carbon Brief’s permanence review.

Liability clarity is essential to sustain equivalence claims over credit lifetimes, a point emphasized across integrity frameworks and buyer guidance captured by Oxford’s 2024 principles update.

Move 6 — Build a balanced pipeline and offtake mix

Balance today’s high‑integrity reductions (e.g., jurisdictional REDD+ with strong leakage accounting) with pilot allocations to durable removals (DACCS, mineralization) to grow capacity; Oxford encourages early support for innovation alongside a clear transition to removals in the revised offsetting principles. Integrity Council CCP alignment can help screen reductions today while durable capacity scales under CCP‑compatible rules at ICVCM.

Transitioning portfolios over time reflects the dual shift (reductions→removals, short‑lived→long‑lived) discussed in Carbon Brief’s market explainer.

Move 7 — Standardize your procurement playbook

Institutionalize a diligence pack: project design docs, baseline and additionality evidence, leakage analysis, permanence buffers, registry status, and verifier statements aligned to CCP norms; a uniform binder improves comparability and auditability under the Core Carbon Principles. Require document refreshes at issuance so claims track verified outcomes rather than forecasts, addressing concerns detailed in Carbon Brief’s offsets critique.

Tracking Oxford type and CCP status in a single register simplifies disclosures and keeps the glidepath visible per Oxford’s portfolio framework.

Move 8 — Disclose portfolio mix and progress annually

Publish volumes by Oxford type, storage durability, geography, and standard/registry, and report progress toward durable removal targets in line with Oxford’s revised guidance on trajectory transparency. Explain methodology and any deviations to maintain trust, echoing integrity recommendations synthesized in Carbon Brief’s long‑form.

This level of disclosure is increasingly expected by stakeholders and makes third‑party assessments more straightforward, as reflected in Oxford’s principles hub.

Move 9 — Anticipate convergence and regulation

Expect convergence among CCPs, claims codes, and national guidance; staying aligned to ICVCM’s Core Carbon Principles and Oxford’s claims trajectory reduces rework as regulations clarify acceptable offsetting in net‑zero plans. Carbon Brief’s explainer captures where controversies are pushing policy toward durable removals and stronger claims standards in the offsets Q&A.

Being early on durable removals and rigorous disclosure positions organizations ahead of policy changes and investor expectations, consistent with Oxford’s revised principles.

Move 10 — Train teams to counter myths with facts

Equip communicators with prebunks and debunks on common offset myths: “all offsets are greenwashing,” “avoided emissions equal durable removals,” “buffers solve permanence.” Clear, referenced explanations grounded in Oxford and CCPs help maintain trust when discussing portfolios, drawing on the durable‑vs‑short‑lived distinctions summarized by Oxford’s principles and permanence concerns in Carbon Brief’s overview.

Internal literacy shortens procurement cycles and improves claim accuracy, aligning language across investor updates and sustainability reports in line with ICVCM’s CCP language.

Opinion

Verified offset markets are finally separating signal from noise, and the advantage now lies with buyers who treat credits like long‑lived assets: hard screens up front, disciplined MRV and liability terms, and transparent claims that evolve toward durable removals. Portfolios that adopt Oxford’s trajectory and CCP‑style due diligence will avoid most reputational traps while helping scale the capacity the world actually needs, as framed in Oxford’s revised principles and integrity discussions in Carbon Brief’s Q&A.

FAQs — Advanced Guide to Verified Carbon Offset Markets

How should credits be used in a net‑zero plan?

Cut value‑chain emissions first and use credits for residuals; migrate portfolios toward durable removals by the net‑zero date per Oxford’s revised offsetting principles, with claims calibrated to durability as explained in Carbon Brief’s overview.

What minimum quality checks should be non‑negotiable?

Additionality, strong baselines, conservative leakage, permanence buffers/liability, and auditable MRV—aligned to the Integrity Council’s Core Carbon Principles—before any reliance on ratings, consistent with risk themes in Carbon Brief’s Q&A.

Why classify by Oxford types?

Because durability and action type affect claim integrity; the revised 2024 Oxford framework sets a clear trajectory from reductions to durable removals and from short‑ to long‑lived storage, summarized in the principles update and the principles hub.

Learn More

Explore practical next steps and foundational concepts in one place: start by testing scenarios with the free Coffset Carbon Footprint Calculator, then build fluency with our explainers What Is a Carbon Footprint?, What Is Carbon Offsetting?, and Reduce vs Offset: Why Both Matter. For more resources, visit the Coffset homepage, explore the Carbon Learning Center, or take action via Buy Carbon Credits.

Sources

- Oxford Smith School — Revised Oxford Principles (2024): https://www.smithschool.ox.ac.uk/sites/default/files/2024-02/Oxford-Principles-for-Net-Zero-Aligned-Carbon-Offsetting-revised-2024.pdf

- Oxford Smith School — Offsetting Principles hub: https://www.smithschool.ox.ac.uk/research/oxford-offsetting-principles

- ICVCM — Core Carbon Principles (CCPs): https://icvcm.org

- Carbon Brief — In‑depth Q&A on carbon offsets and permanence: https://interactive.carbonbrief.org/carbon-offsets-2023/index.html